Introduction

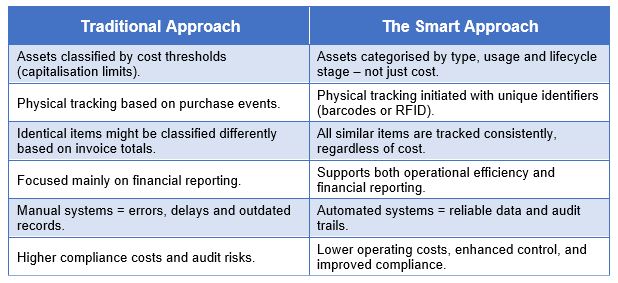

Successfully implementing asset tracking requires major changes to an organisation’s policies, processes, and responsibilities. Historically, organisations focused more on financial accounting than on the physical tracking of assets, leading to outdated and un-auditable records, especially as asset volumes grew and manual systems became overwhelmed. Practices like high capitalisation limits and grouped purchases eased workloads but compromised data integrity. With service-based businesses, assets are now more numerous, smaller, and more mobile, making traditional asset control methods ineffective.

Fixing these issues demands a fresh, organisation-wide approach—asset management cannot be handled by accounting alone. This discussion outlines a review of current asset management challenges, effective tools and techniques, common failures, and proven best practices.

Asset Definition

A crucial foundation for successful asset management is having a clear, consistent, and widely understood definition of what constitutes an asset. An asset is typically the lowest level item commonly managed, with a useful life over one year, and used to produce income or facilitate service delivery. It is most effective to define assets by categories and type, eg. ICT equipment, tooling or furniture, rather than using factors like cost alone.

Each asset must be assigned a unique physical label, typically a barcoded tag, which serves as its identifier in the asset database. RFID technology offers new potential for certain asset tagging applications, but requires Proof of Concept (POC) testing, which can be costly along with the associated tags and hardware.

Cost should not determine whether an item is managed; relying on capitalisation limits weakens internal controls and causes confusion. Instead, categorising assets by their use creates a meaningful, detailed database that supports management processes. Capitalisation limits should apply to financial transactions only, whilst automating the asset management system will support better data accuracy, audit trails, and reduced costs.

Smart Practice: Asset Definition

- Asset is defined as the lowest level of individual item commonly managed.

- All assets are identified with a barcode/RFID asset label.

- All items within a category are identified regardless of cost.

- Capitalisation limits determine accounting treatment, rather than physical asset tracking and visibility.

- Assets are identified and recorded individually, not by groups.

Asset Management Responsibilities

Once an organisation has agreed on the definition of an asset, it must adapt its daily operations to keep asset data accurate and current. A key smart practice is the clear segregation of duties: operations management is responsible for managing and safeguarding physical assets, while the accounting team focuses only on the financial aspects of capital assets.

Ops managers are tasked with recording asset additions, updates, movements, and disposals, and must be held accountable for the accuracy of this information. Meanwhile, fixed asset accountants maintain financial records tied to these assets.

Security is essential: Ops managers should not have access to sensitive financial information, and accountants should not be expected to initiate asset management activities for assets they do not directly oversee. To maintain data integrity, some organisations create separate databases for asset inventory and fixed asset accounting, or apply strict user profiles to control access.

Asset transactions should be recorded in real time as they occur in the operations, with core information (like asset number, description, location, serial number and condition) entered immediately—even if financial details are pending.

To support ongoing accuracy, asset labelling using barcodes enables fast, reliable inventories without requiring specialised knowledge from staff. With barcode scanning, organisations can easily set the frequency and scope of audits, ensuring better control and visibility over their assets.

Smart Practice: Asset Management Responsibilities

- Responsibility for non-financial transaction activity is assigned to operations

management; financial data remains in the accounting department.

- Segregate data between finance and non-finance protected by adequate

domain control.

- Define and document processes, duties and data partitioning for both systems.

- Record transactions upon their occurrence within the operations.

- Create audit processes to assure that the systems operate properly.

System Interoperability

One of the key advantages of implementing an asset management system is its ability to seamlessly interface transaction data with the fixed asset accounting system, removing the reliance on outdated forms, documents, and manual entries from other systems. These traditional methods often lead to inaccuracies and internal control vulnerabilities. The way the interface operates depends on the system architecture: if both systems share a common database or are linked at the database level (eg. asset code or barcode tag), data flow occurs automatically. However, if the systems are separate, physical data exports are required.

To ensure accurate integration, it’s crucial to identify which assets are considered capital assets. This can be done by categorising assets based on common descriptions, types or identifiers, allowing for automatic classification as new assets are added. This method ensures consistency and can be easily managed by the accounting department, especially with relational databases. In such systems, the cost is assigned at the individual asset level, and the capitalisation policy is based on both the type of asset and its cost.

During each accounting period, the process involves identifying transactions based on activity type, reviewing any transactions with financial impact to ensure accuracy, and then adding the transaction details for entry into the fixed asset accounting system. Timing differences between physical receipt and cost determination may cause transactions to occur in different accounting periods. Once complete, the transactions are applied to the fixed asset accounting ledgers.

Each organisation and implementation type will define the specific steps needed for integration based on their system design and processes.

Smart Practice: System Interoperability

- Define asset capitalisation policy based on category/type and unit cost considerations.

- Define data capture requirements based on timing and availability of data.

- Create accounting procedures to identify transactions of common type, adding each with appropriate financial data.

- Design processes to resolve timing differences between actual transaction dates and

availability of complete data.

The Smart Asset Management Approach

Conclusion

Implementing an asset inventory system requires rethinking past practices and leveraging current software tools, with an organisation-wide approach that assigns responsibility to those best suited for the asset management task.

It’s important to allocate resources for cleaning up existing asset records, including staff hours for potential financial record adjustments. Budgets should cover the costs of software, hardware, asset tagging, and training. Despite the challenges, the current regulatory environment makes implementing a comprehensive asset management system essential.